When businesses are considering a new software solution, there’s frequently a concern that transitioning to a new system will be expensive or hard to implement. But when it comes to choosing whether or not to automate a manual process, doing nothing can be much more costly and difficult in the long run.

Maintaining manual, paper-based processes can be especially problematic for accounts payable. Even if you understand the potential benefits of automating AP – improving controls and safeguards while saving time and money – you may not know how your existing process can improve.

To help clarify, here are the key differences to consider when comparing an automated solution to a manual one.

- Invoice Processing

Manual: Processing invoices manually is labor intensive. It requires team members to perform data entry, verify invoice information, and store documents.

Automation: When the process is automated, staff members don’t need to handle invoices as vendors send them in. An automated system will process invoices through centralized entry points, taking away the need for team members to do all the manual work.

- Approvals

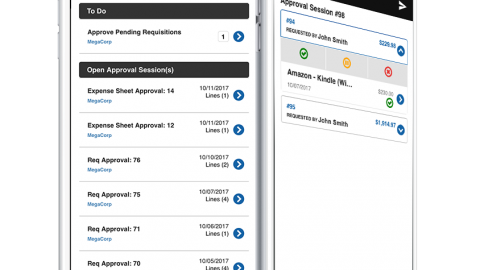

Manual: Manual approval workflows create a lot of headaches and holdups that can be further complicated when teams work remotely. Extra time is needed to properly route invoices to the right people and things can get lost in the cracks, leading to errors and late payments.

Automation: Automated solutions route invoices to the appropriate workflows for coding and approval. Approval workflows can be customized so the right invoices are always routed to the right people, and approvers are notified whenever something lands in their queue.

- Payments

Manual: Processing paper checks in house requires printing, folding, envelope stuffing, stamping, and mailing payments to vendors. Processing ACH payments involves facilitating batches of payments through a business bank account. This process can be time-consuming, especially when it comes to paper checks and handwritten signatures.

Automation: Payment approvers can oversee and schedule payments in a single platform, from the office or remotely. Scheduled payments, whether paper check or electronic, are processed by the automation platform.

- Document Storage

Manual: When it comes to a manual or paper-based system, staff members are responsible for looking through paper records or recalling electronic files to look up info. Accessing an older file could take some digging.

Automation: Invoice images, payment data, and images of checks can be recalled with a couple clicks. Staff members will never be at a loss in the event of an audit or inquiries from vendors.

- Integration with Acumatica

Manual: Manual processes become even more cumbersome when working with state-of-the art accounting or ERP systems like Acumatica, and they make it difficult to scale your business.

Automation: AP automation software will easily sync invoice and payment data with accounting platforms, so everything is stored securely and reconciled properly. With AP platform Paypool, customers can sync their invoice and payment records with Acumatica so everything is properly accounted for.

Automate Your AP Process

Paypool’s invoice to payment solution improves the whole AP process, eliminating manual tasks, cutting costs, and saving time. Learn how Paypool can improve your organization’s AP, and drop us a line to learn about our Acumatica integration.