If your business is like most out there, your team is handling finance operations manually through spreadsheets. But as you may have noticed, spreadsheets don’t seem to cut it. They’re error-prone, time-consuming, and repetitive–not to mention frustrating. Imagine if all that time and effort updating spreadsheets and chasing down payments were directed towards more impactful improvements for your team?

As companies grow and transform, they need to modernize their finance operations to transition their accounts receivable (AR) department into revenue heroes. Collections software has made it possible to accomplish past tasks with more speed and reliability, creating an increasing need for you to keep up with competitors or a growing client-base without losing productivity. Whatever solution you choose, it should support some of the basic strategies finance teams need to leverage for better AR management:

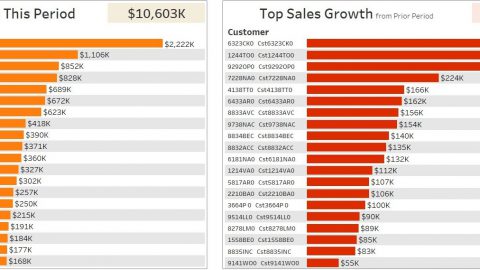

- Visibility: Clearly define your metrics and keep them highly visible. Whether you are on the finance, sales, or customer success team, anyone who impacts customer relationships should have easy, real-time access to these metrics. Understand ahead of time the implications of metric shifts and identify the corresponding collections and customer success actions that must be taken as a result.

- Predictability: Be strategic instead of reactive in managing customer relationship. See if you can detect any patterns in your customer’s payment behavior. Do late payments happen around specific goods or services? Is there seasonality in payment time for customers in different industries? Knowing the drivers of late payment and payment disputes can help you stay ahead of bad debt and plan communications accordingly.

- Self-Service: Self-service is a form of customer empowerment as well as supplier empowerment. By providing a simple-to-use customer portal, not only are your customers able to take ownership of their outstanding invoices, but you can also take back the reins in determining payment options.

ERPs are powerful, but not necessarily tailored to your company’s needs. It’s up to the purchasing company to transform it into a bespoke tool for their team. Third party apps exist to help companies customize their ERP experience and potentially turn the investment into a breakthrough improvement. The right AR software solution can help Acumatica customers see increases of cash inflow and time savings by allowing their finance team to manage more invoices and customers, while at the same time spending less time on repetitive tasks.

So if you are looking to get more out of Acumatica for your collections workflow, take a look at our Definitive Guide to Buying an Automated AR Solution. If you find that what you’re looking for is automating your collections workflow, check us out!